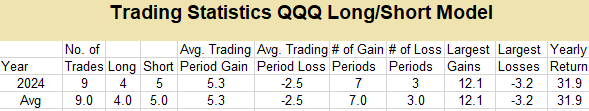

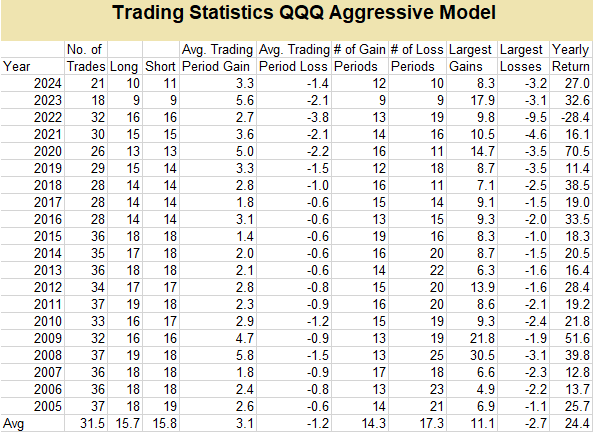

Definition of headings in the tables below (each row/line relates to a specific year):

• No. of Trades – total number of trades

• Long – number of long positions

• Cash – number of hold cash positions

• Short – number of short positions

• Avg. Trading Period Gain – the average percentage gain of the profitable trades

• Avg Trading Period Loss – the average percentage loss of the nonprofitable trades

• No. of Gain Periods – the number of trades that were profitable

• No. of Loss Periods – the number of trades that were nonprofitable

• Largest Trading Period Gains – the largest percentage profitable trade

• Largest Trading Period Losses – the largest percentage nonprofitable trade

• Yearly Return – percentage sum of of all profitable and nonprofitable trades

Please note that the number of gain and loss periods may not equal the total number of trades due to cash positions and even result trades.

Special Note: Short sell positions (shown in the below tables) can be replaced with the inverse fund ProShares Short QQQ (PSQ) (-1x). PSQ seeks a return that is -1x the return of an index or other benchmark (target) for a single day, as measured from one NAV calculation to the next. Other inverse and leveraged Nasdaq-100 ETFs can be found on here.

Both systems — (1) Long/Short & Long/Short/Cash Models, and (2) Aggressive & Moderate Models were running simultaneously in Year 2024. We decided to end the Aggressive and Moderate Models at the end of Year 2024, and continue with the Long/Short & Long/Short/Cash Models. Through extensive backtesting, the Long/Short & Long/Short/Cash Models are producing higher returns using the new and improved mechanical rules-based system.

Long/Short Model

The Long/Short model began on January 1, 2024.

Long/Short/Cash Model

The Long/Short/Cash model began on January 1, 2024.

We discontinued the Aggressive and Moderate Models on December 31, 2024. Below are the statistical results.

Aggressive Model

Moderate Model

|