QQQTrading.com, LLC is a leading professional financial service that provides profitable trading

signals for the Nasdaq-100 tracking stock (QQQ). Our primary objective is to help money managers, investors,

and traders increase their capital in a low-risk/high-reward manner in both bullish and bearish markets.

Many financial advisors (FAs) invest their client's assets using the Modern Portfolio Theory (MPT). MPT is a theory of finance which attempts to maximize portfolio expected return for a given amount of portfolio risk, or equivalently minimize risk for a given level of expected return, by carefully choosing the proportions of various assets. Although MPT is widely used in practice in the financial industry, in recent years the basic assumptions of MPT have been widely challenged by fields such as behavioral economics. One reason is due to the major fluctuations of the stock and bond markets. When both of these major entities are performing poorly, investors will be at high risk using this concept.

|

In nearly all portfolios of the MPT, a certain percentage is diversified in the Invesco QQQ Trust (QQQ). This stock, like all stocks, will always fluctuate over time. Trying to determine its price at any given moment based on economic conditions or fundamental analysis is nearly impossible. We have designed a system for trading QQQ with results that consistently outperform the buy-and-hold strategy of investing. |

|

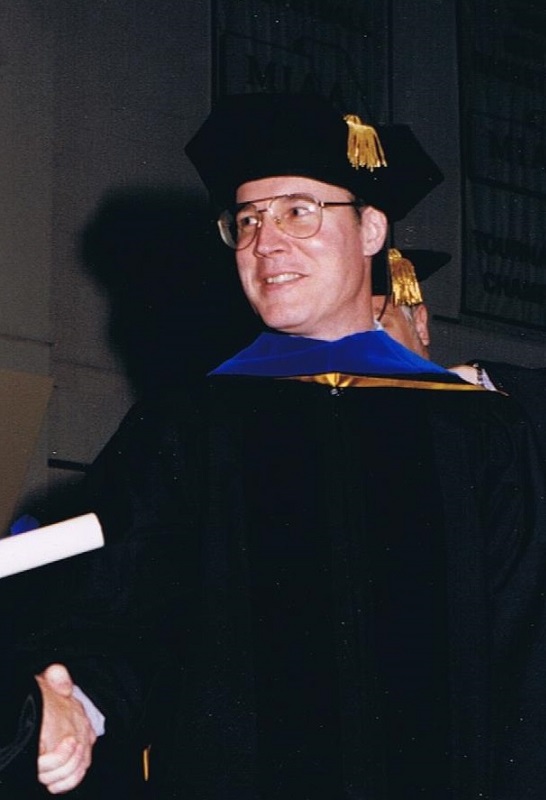

Our chief technical chart analyst and developer of the service is Robert W. Dillon, Ph.D. Robert holds a masters and doctorate degree in the fields of Geology and Geophysics from the Missouri University of Science & Technology. He graduated magna cum laude in his post-graduate degrees.

Robert has over 30 years of experience trading the stock market and specializes in technical analysis. He has a vast amount of experience in interpretation of highly complex charts. Robert is also a master fingerstyle guitarist. The combination of his scientific and creative abilities with the stock market using technical analysis, gives him a pure analytical advantage over traditional strategies used by money managers.

Due to his success in the financial world, he became semi-retired at the age of 41 and has been providing financial guidance to his customers since year 2001. He holds the highest level of ethical standards and avoids any conflicts of interest.

|

He has watched the markets evolve well before the Internet with all transactions conducted over the phone through a stock broker, gathering information from newspapers, articles posted in the Wall Street Journal, and company reports with outdated charts. In the early-1980's, he remembers creating his own charts by plotting daily stock prices obtained from the newspapers. Soon after the birth of the Internet in 1983, basic charting software gave rise to technical analysis. Since then, Robert has tested & experimented with almost every style of technical trading. He has extensively traded the market and experienced every imaginable technical and emotional situation with trading stocks. |

|

Through all of that, the greatest teacher of course, is the market itself. And while the speed and method of execution may change, the fundamental truths that underly technical analysis remain the same. Fear and greed reflected in crowd dynamics will always be represented within a simple price (and volume) vs. time chart.

|

Trading signals may be provided to Registered Investment Advisors (RIAs) who manage Assets Under Management (AUM) on a contract basis. Performance results are independently verified by TimerTrac.

Dr. Dillon is not a registered or licensed investment advisor or broker-dealer. His clients are individual investors and professional investment advisors. He has many financial advisors and money managers who use his trading signals for their clients. All returns are published on the site. |

|

|